5 things to know about Saudi Arabia and the world's biggest listing

News24

04 Nov 2019, 19:14 GMT+10

Ultra-conservative Saudi Arabia is undergoing a major transformation under Crown Prince Mohammed bin Salman, who intends to end the kingdom's addiction to oil revenues.

As the country opens up on the economic front, there have also been some social reforms including more freedoms for women, but progress has been erratic and critics pushing for faster changes have ended up in jail.

The crown prince's most ambitious economic initiative so far has been to push the state energy giant Aramco towards a stock market debut. After years of delays, the green light was announced on Sunday.

After years of stop-start progress towards the IPO, scepticism abounds and the new stock will be under close scrutiny when it launches on the Saudi bourse in coming weeks.

Apart from holding out for the big-ticket valuation, the delays are also said to be related to Saudi concerns that a foreign listing could shine an unwelcome light on the secretive company's finances and inner workings.

"Should shares fall sharply after they begin trading, it would be a highly visible blow to the credibility of the economic reforms so closely associated with Mohammed bin Salman, which is why the valuation is so important," said Kristian Ulrichsen, a fellow at Rice University's Baker Institute in the United States.

"International investors will pay very close attention to how Aramco performs on the domestic exchange, especially in the absence of any firm detail over the international portion of the eventual dual listing."

Why is Aramco so important?

Aramco pumps about 10 percent of the world's oil from its wells beneath the desert sands - mostly in the kingdom's east but also in the evocatively named "Empty Quarter" in the south. There are also some major offshore oil fields.

The energy behemoth generated the most profit of any corporation last year with net income of $111 billion - more than Apple, Google's parent Alphabet and Exxon Mobil combined.

The fate of Aramco is fundamental to world energy supplies - which was illustrated when oil prices were sent spiking after two of its facilities were targeted with strikes in September, temporarily knocking production down by half.

How is MBS remaking the economy?

Even before he became crown prince in June 2017, the son of King Salman -- often known by his initials MBS -- had announced a plan to diversify the economy and push it away from its long reliance on oil.

Since then, the kingdom has witnessed a number of never-before-seen initiatives, mostly related to entertainment and tourism, including vast multi-island luxury destination projects.

Women were made more welcome in the workforce, concerts opened to Saudis, international sports events were given the green light, and the first tourist visas were issued.

Amid low oil prices, the kingdom also increased the prices of fuel and electricity, imposed a five percent value added tax (VAT) and levied duties on 11 million expatriates in a bid to generate additional revenue.

Selling the crown jewels

Aramco's IPO has generated a feeling of pride among Saudis, although some are concerned about sharing the "family jewel" with foreigners.

"Aramco means family. From the work environment to the personalities you come across, it feels natural. It feels like home," Naif Ghofaily, an Aramco employee in his 30s, told AFP.

"The sale has brought a lot of exposure for the company on a global scale. Although one of the biggest companies in the world long before its proposed listing, I feel as if many more people recognise Aramco today."

Many of the employees live on plush company compounds, meaning that their immersion is total - particularly in a country where cities and towns offer few attractions.

For another employee, 33-year-old Haya, the landmark IPO risks "changing" the company.

"I was born in Aramco, my dad worked for Aramco for more than 50 years, both my parents retired from Aramco, I live in Aramco. To me Aramco is my home," she told AFP.

"I'm feeling nervous about the IPO, I grew up planning for my kids to live the life I experienced in Aramco and I'm worried that with the IPO it won't be the Aramco that we know."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Irish Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Irish Sun.

More InformationInternational

SectionTrump orders U.S. to join Netanyahu's war on Iran

WASHINGTON, DC - U.S. President Donald Trump how bowed to pro-Israel elements in his administration and Congress, announcing that the...

Swiss National Bank responds to strong franc and US trade doubts

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation,...

New U.S. guidelines may cut daily alcohol limit from advice

WASHINGTON, D.C.: The U.S. government is preparing to revise its influential dietary advice, with a significant shift: dropping the...

UBS: Over 379,000 Americans became millionaires last year

ZURICH, Switzerland: The U.S. saw an extraordinary rise in wealth last year, with more than 1,000 people crossing into millionaire...

The Hague faces lockdown for global leaders' meet

THE HAGUE, Netherlands: The city that prides itself on being a beacon of peace and justice—home to institutions like the International...

Drug shortages and layoffs spark health crisis in Argentina

BUENOS AIRES, Argentina: Since taking office in December 2023, Argentine President Javier Milei has implemented sweeping austerity...

Europe

SectionSwiss National Bank responds to strong franc and US trade doubts

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation,...

The Hague faces lockdown for global leaders' meet

THE HAGUE, Netherlands: The city that prides itself on being a beacon of peace and justice—home to institutions like the International...

Senator Duffy lauds proposed laws against vaping in Ireland

DUBLIN, Ireland: Fine Gael Senator Mark Duffy says new laws to regulate vaping products will help make them less attractive to young...

REE misjudgment caused April blackout, says Spain's energy chief

MADRID, Spain: A routine oversight by Spain's power grid operator, REE, has been identified as the trigger behind the large-scale blackout...

Ireland MP Paul Murphy released by Egyptian authorities on June 16

DUBLIN, Ireland: Egyptian authorities released Paul Murphy, TD, from the People Before Profit party after his second detention on June...

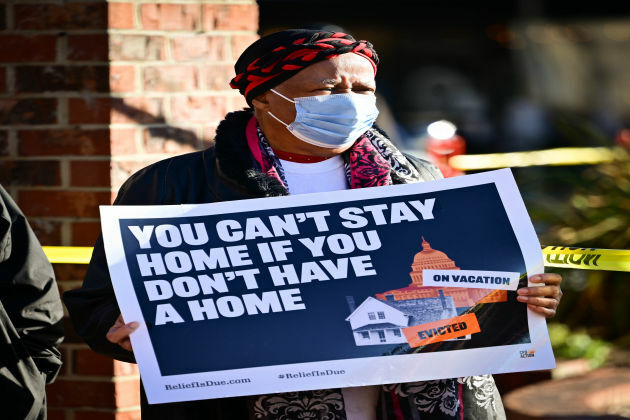

Demonstrators in Dublin decry homes as investment assets, not shelter

DUBLIN, Ireland: In a significant demonstration outside Leinster House in Dublin, hundreds of housing protesters voiced their frustration...