Swiss National Bank responds to strong franc and US trade doubts

Mohan Sinha

21 Jun 2025, 23:39 GMT+10

- The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation, the strong Swiss franc, and uncertainty caused by unpredictable U.S. trade policies

- The SNB reduced the rate by 0.25 percentage points, down from 0.25 percent, as expected by financial markets and a Reuters survey

- Switzerland is now close to returning to negative interest rates—a policy it had from 2014 to 2022 that was unpopular with banks, savers, and insurers

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation, the strong Swiss franc, and uncertainty caused by unpredictable U.S. trade policies.

The SNB reduced the rate by 0.25 percentage points, down from 0.25 percent, as expected by financial markets and a Reuters survey. This marks the sixth time in a row the central bank has cut rates since it began easing in March 2024.

Switzerland is now close to returning to negative interest rates—a policy it had from 2014 to 2022 that was unpopular with banks, savers, and insurers.

"In recent months, inflation has fallen," the SNB said. "Today's rate cut is meant to support the economy and keep inflation under control."

Inflation in Switzerland turned negative in May for the first time in four years, dropping below the SNB's target of zero to two percent. The Swiss franc briefly strengthened after the rate cut was announced, but later returned to its previous level, trading at 0.8191 francs per U.S. dollar.

The SNB expects the global economy to slow down in the coming months. It also predicts U.S. inflation to rise, while inflation in Europe is likely to keep falling. However, the bank noted that the global outlook remains uncertain. If trade tensions worsen, the global economy could slow down further. On the other hand, stronger government spending in some countries might support growth.

Switzerland's decision came on a busy day for central banks. Norway surprised markets with its first rate cut in five years, and the Bank of England was set to announce its rate decision later in the day. Earlier this month, the European Central Bank also cut its rate, and this week, the U.S. Federal Reserve held rates steady but said it might lower them later this year.

UBS economist Alessandro Bee explained that the SNB's move was partly to stop the Swiss franc from becoming too strong. The recent U.S. tariffs announced in April have created economic pressure, and a stronger franc hurts Swiss exporters and could push inflation down even more.

EFG economist GianLuigi Mandruzzato said the effects of the franc's strength will become clearer in the months ahead. He expects the SNB to pause further rate cuts unless the Swiss economy takes a sharp turn for the worse due to U.S. trade policies.

Mandruzzato also noted that the SNB's statement shows great concern about global developments. The bank is keeping all options open, including returning to negative interest rates and entering foreign exchange markets if needed.

Swiss bond yields also suggest markets expect interest rates to fall below zero again. So far in 2025, the franc has risen about 11 percent against the dollar, which has made imports cheaper and helped lower inflation.

The SNB says it may intervene in the currency markets if necessary to keep inflation on track. However, the U.S. recently added Switzerland to a list of countries being monitored for possibly manipulating currency and trade.

"The SNB's main concern may not be avoiding the impression of being a currency manipulator – still, it is politically wise not to appear too trigger-happy to go negative with the policy rate," said Karsten Junius, chief economist at J Safra Sarasin.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Irish Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Irish Sun.

More InformationInternational

SectionSwiss National Bank responds to strong franc and US trade doubts

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation,...

New U.S. guidelines may cut daily alcohol limit from advice

WASHINGTON, D.C.: The U.S. government is preparing to revise its influential dietary advice, with a significant shift: dropping the...

UBS: Over 379,000 Americans became millionaires last year

ZURICH, Switzerland: The U.S. saw an extraordinary rise in wealth last year, with more than 1,000 people crossing into millionaire...

The Hague faces lockdown for global leaders' meet

THE HAGUE, Netherlands: The city that prides itself on being a beacon of peace and justice—home to institutions like the International...

Drug shortages and layoffs spark health crisis in Argentina

BUENOS AIRES, Argentina: Since taking office in December 2023, Argentine President Javier Milei has implemented sweeping austerity...

Volcanic ash grounds flights to Indonesia, disrupts travel to Bali

LEMBATA, Indonesia: Indonesia's Mount Lewotobi Laki Laki erupted dramatically on June 18, generating substantial ash and smoke plumes....

Europe

SectionSwiss National Bank responds to strong franc and US trade doubts

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation,...

The Hague faces lockdown for global leaders' meet

THE HAGUE, Netherlands: The city that prides itself on being a beacon of peace and justice—home to institutions like the International...

Senator Duffy lauds proposed laws against vaping in Ireland

DUBLIN, Ireland: Fine Gael Senator Mark Duffy says new laws to regulate vaping products will help make them less attractive to young...

REE misjudgment caused April blackout, says Spain's energy chief

MADRID, Spain: A routine oversight by Spain's power grid operator, REE, has been identified as the trigger behind the large-scale blackout...

Ireland MP Paul Murphy released by Egyptian authorities on June 16

DUBLIN, Ireland: Egyptian authorities released Paul Murphy, TD, from the People Before Profit party after his second detention on June...

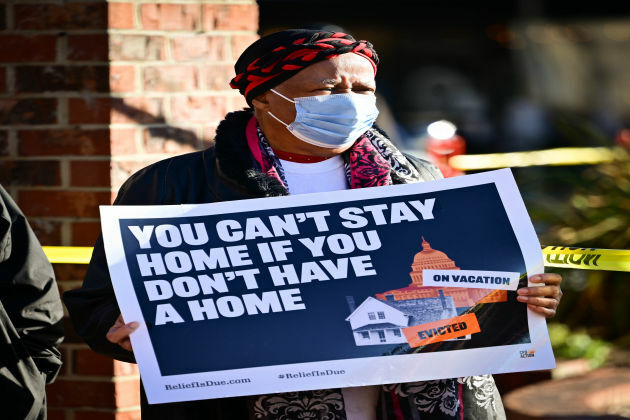

Demonstrators in Dublin decry homes as investment assets, not shelter

DUBLIN, Ireland: In a significant demonstration outside Leinster House in Dublin, hundreds of housing protesters voiced their frustration...