Digant Sharma Engages with Luxembourg's Leading Investment Bodies, LPEA & ALFI, Managing EUR7 Trillion, for Strategic Investments in India

ANI

08 Mar 2025, 10:41 GMT+10

SMPL

Luxembourg / New Delhi [India], March 8: In a significant step towards fostering international investment collaboration, the Luxembourg Private Equity & Venture Capital Association (LPEA) and The Association of the Luxembourg Fund Industry (ALFI) visited India to explore investment opportunities in India's rapidly growing sectors. This initiative aligns with Indian Prime Minister Narendra Modi's vision of transforming India into a $5 trillion economy through strategic global partnerships and investments. Among the prominent figures invited to meet LPEA and ALFI was Digant Sharma, a distinguished business leader and investment strategist.

Digant Sharma has over 18 years of experience spanning multiple industries, including finance, technology, energy, agriculture, and infrastructure. As the Chairman of Torus Innotech Pvt Ltd, he has played a key role in driving high-impact global investments, fostering sustainable development, and building strategic partnerships across Europe and Asia. His leadership has significantly contributed to economic growth, social welfare, and corporate social responsibility (CSR) initiatives like Undertrial Welfare Association , Sobhagya Yog Sadhna Foundation and more.. Beyond business, Sharma is deeply committed to social causes, leading initiatives in education, environmental sustainability, and rural development, aligning with India's vision for inclusive economic progress.

Strengthening Financial Partnerships Between Europe and India

Luxembourg, a global financial powerhouse, serves as the European hub for investment funds, managing an impressive EUR7 trillion in assets. The discussions between Mr. Sharma, Mr. Stephane Pesch, CEO of LPEA, and Mr. Serge Weyland, CEO of ALFI, centered on unlocking India's investment potential, particularly in areas aligned with the country's economic expansion and focus on sustainability majorly focussed in Agriculture , Landfill Cleaning and an AI-Powered Bridge Funding Investment Model for Government Projects to consume upto Euro 1.5 Trillion with a brief project report shared with Mr Luis Galveias - COO of LPEA.

LPEA and ALFI are key institutions in Luxembourg's investment landscape. LPEA represents private equity and venture capital investors, fostering global partnerships, while ALFI plays a critical role in shaping Luxembourg's asset management and investment fund ecosystem, ensuring that global investors leverage Luxembourg's well-established financial expertise.

During the discussions, Sharma presented investment opportunities in India, with a particular focus on:

* Agriculture & Agri-Tech Innovation (Torus Innotech): Developing sustainable farming technologies, precision agriculture, supply chain digitization, and food security initiatives.

* Landfill Cleaning & Waste Management (Ophi Technologies): Addressing India's pressing waste management challenges through large-scale landfill cleanup projects, recycling, and sustainable waste disposal solutions.

* Renewable Energy & Sustainability: Collaborating on green energy projects, including solar, wind, and circular economy initiatives.

* Infrastructure Development: Expanding eco-friendly infrastructure projects such as smart cities, urban mobility, and environmental conservation initiatives.

* Technology & Startups: Strengthening venture capital partnerships to accelerate India's booming startup ecosystem.

Luxembourg's Investment Interest in India's Green Economy

Luxembourg has demonstrated a growing interest in supporting and investing in India's green economy, particularly through sustainable finance and renewable energy initiatives.

Sustainable Finance Initiatives

In November 2020, during a virtual summit between the Prime Ministers of India and Luxembourg, three key Memoranda of Understanding (MoUs) were signed to bolster financial cooperation with a focus on green finance:

1. MoU between India International Exchange (India INX) and Luxembourg Stock Exchange: This agreement facilitates cooperation in financial services, emphasizing environmental, social, and governance (ESG) standards and green finance in both markets.

2. MoU between State Bank of India (SBI) and Luxembourg Stock Exchange: This pact aims to enhance collaboration in financial services, particularly in maintaining orderly securities markets and promoting ESG and green finance initiatives.

3. MoU between Invest India and Luxinnovation: This agreement seeks to support mutual business cooperation between Indian and Luxembourgish companies, including the promotion and facilitation of inbound foreign direct investment, with a focus on sustainable projects.

Green Bond Collaborations

Luxembourg's financial ecosystem has been instrumental in supporting India's green bond market:

* State Bank of India's Green Bond Listing: In November 2021, SBI's $650 million green bonds were dual-listed on the Luxembourg Stock Exchange (LuxSE) and India INX, marking a significant milestone in sustainable finance collaboration between the two countries.

* Power Finance Corporation's Green Bond: In June 2022, a EUR300 million green bond issued by India's Power Finance Corporation was registered on LuxSE's Securities Official List and displayed on the Luxembourg Green Exchange (LGX), the world's leading platform for sustainable securities.

Opportunities in Renewable Energy

India's renewable energy sector presents substantial opportunities for foreign investors:

* Wind Energy: India boasts the world's fourth-largest wind-generation capacity, with approximately 45 GW installed. This capacity is expected to increase by 60% to 71 GW by FY 2030, offering lucrative investment prospects.

* Government Initiatives: Policies such as the National Solar Mission and the Green Energy Corridor are designed to promote renewable energy development, making the sector attractive to foreign investors.

With India's agriculture sector undergoing rapid transformation through technology-driven solutions and sustainability initiatives, Torus Innotech presents a lucrative investment opportunity for European investors looking to support large-scale agri-tech advancements. Similarly, Ophi Technologies, a Finland-based company, is leading efforts in landfill cleaning, addressing India's urgent need for efficient waste management solutions to combat environmental hazards.

Luxembourg's well-established expertise in impact investing, asset management, and venture capital makes it an ideal financial partner to support these transformative projects in India, helping achieve India's $5 trillion economy goal by fueling innovation, entrepreneurship, and sustainable industries.

Leaders Speak on Strengthening India-Luxembourg Investments

Digant Sharma emphasized the critical role of foreign direct investments (FDIs) in India's sustainable growth, stating:

'India presents a vast and dynamic investment landscape, particularly in agriculture, Infrastructure and sustainable waste management. Luxembourg's financial institutions bring unparalleled expertise in structured investments, and engaging with LPEA and ALFI has opened up new avenues for collaboration. This will drive impactful, long-term growth for both economies and contribute towards realizing India's $5 trillion economy vision of my Prime Minister Narendra Modiji.'

Stephane Pesch, CEO of LPEA, highlighted Luxembourg's growing interest in India's sustainable sectors and commitment to strengthening relationships with Indian counterparts through collaborative opportunities in private equity and venture capital.

Serge Weyland, CEO of ALFI, echoed similar sentiments, emphasizing Luxembourg's role as a leading cross-border investment fund center that facilitates the transition towards more sustainable economies globally.

A Strategic Roadmap for Future Investments

The high-level discussions established a structured investment framework between Luxembourg and India, with plans to develop dedicated investment vehicles for agriculture, waste management projects, and many other industries. As a next step, Digant Sharma will be sharing various projects from varied industries with LPEA and ALFI leadership teams to facilitate investment roadshows, industry roundtables, and investor engagement programs. These initiatives will ensure seamless capital inflows into India's green economy and high-growth sectors.

This meeting marks the beginning of a new era in European-Indian investment relations, unlocking transformative opportunities in sustainable development and reinforcing India's position as a prime destination for global impact investments.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by SMPL. ANI will not be responsible in any way for the content of the same)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Irish Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Irish Sun.

More InformationInternational

SectionCanadians seething over Trump's policies, jibes

CNN - In a recent interview with CNN's Christiane Amanpour, Canadian Foreign Minister Mélanie Joly expressed strong opposition to President...

FedEx Boeing 767 makes emergency landing after bird strike in Newark

NEWARK, New Jersey: Over the weekend, a FedEx Boeing 767 cargo plane hit a bird while taking off from Newark Airport. One of its...

Pentagon requires weekly accomplishment reports after Musk’s demand

WASHINGTON, D.C.: The Pentagon told its civilian employees that they must provide a list of five bullet points detailing their accomplishments...

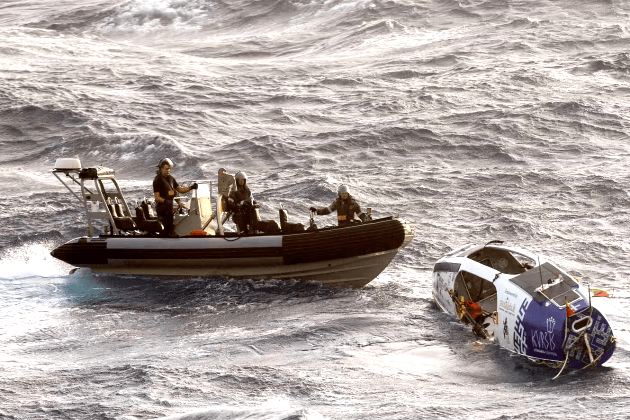

Australian warship rescues Lithuanian adventurer in Coral Sea

MELBOURNE, Australia: An Australian warship rescued Lithuanian adventurer Aurimas Mockus this week after he became stranded in the...

3,000 more active-duty troops sent to US-Mexico border

WASHINGTON, D.C.: The U.S. is sending about 3,000 more soldiers to the U.S.-Mexico border as President Donald Trump pushes to stop...

Members allowed to switch as Medicaid provider loses accreditation

ANNAPOLIS, Maryland: Maryland's largest managed care organization for Medicaid recipients has had its accreditation suspended, prompting...

Europe

SectionDrivers in Ireland overpaid 350,000 euros in tolls in 2024

DUBLIN, Ireland: Drivers in Ireland overpaid more than 350,000 euros in tolls last year across nine motorways and tunnels, according...

Ireland misses EU emissions targets, risks 27 billion euro in fines

DUBLIN, Ireland: Ireland could face fines of up to 27 billion euros for failing to meet EU emissions targets, a new report has warned....

Homeless numbers reach all-time high in Ireland

DUBLIN, Ireland: Homelessness in Ireland has reached an all-time high, with 15,286 people in emergency accommodation in January 2025,...

Galway’s Coffeewerk + Press in Ireland among world's top 50 cafes

DUBLIN, Ireland: Coffeewerk + Press, located on Quay Street in Galway city center, ranked 39th on the prestigious list—it is the only...

Digant Sharma Engages with Luxembourg's Leading Investment Bodies, LPEA & ALFI, Managing EUR7 Trillion, for Strategic Investments in India

SMPL Luxembourg / New Delhi [India], March 8: In a significant step towards fostering international investment collaboration, the...

MLS goal leader Tai Baribo, red-hot Union face Revolution

(Photo credit: Caean Couto-Imagn Images) Tai Baribo will try to continue his stretch as the hottest striker in MLS on Saturday when...